Since our inception we have compiled the largest database of information regarding the problems property buyers have faced in Cyprus, which gives us the most comprehensive and unique view of the practices of the industry and the pitfalls buyers face.

The bulk of the problems stem from the archaic Ottoman land law still in existence in Cyprus which allow these dubious practices. This together with the lack of proper regulation of the industry or enforcement of planning and consumer protection law by the authorities only add to the risks.

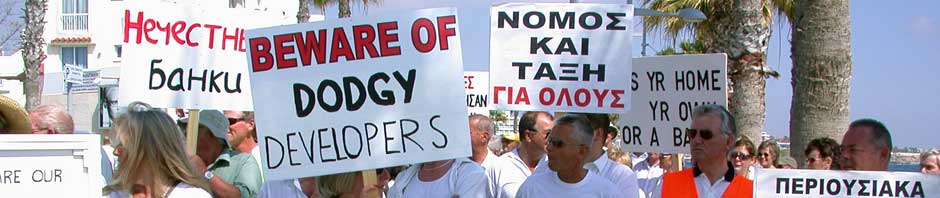

In this risk-laden environment developers, aided and abetted by the banks, and even the buyers’ own lawyers have, and continue to, exploit buyers in different ways.

NB : Anyone can become a property developer in Cyprus without any background checks on qualifications or financial standing.

Problem : Developer Mortgages

The main problems for existing (and future) buyers result from the way the developers have been allowed to finance their business ventures through the unethical and reckless lending of the banks. As Cyprus has the highest interest rates in Europe this has been quite lucrative for the banks in the past – going forward though will be quite a different matter as the debt mountain becomes ever more difficult to service.

In Cyprus an empty building plot can be mortgaged under an agreement solely between the two parties (developer and bank); yet in the event of the developer’s bankruptcy the bank can legally have access to all the buildings on that land which were built subsequently under quite separate legal agreements (involving the same land!) and which did not include the bank as a party to these agreements – how can this arrangement not be fraudulent?

Add to this the fact that a buyer can also have a mortgage on the property they are buying, yet the bank does not reveal to the buyer firstly that, the developer has a mortgage and secondly that, the developer is the guarantor of the buyer’s mortgage. Clearly also, the developer does not reveal to the buyer that he has a mortgage on the building plot.

And all that is required to maintain the secrecy of this unethical and reckless lending arrangement is a buyer’s dishonest lawyer who is also professionally negligent in his or her duty of care to the buyer by not bothering to do a Land Registry search on their behalf.

Obviously, if the legions of lawyers who have been involved in this deceit had done their duty then there would in truth have been no property industry as we know it, as buyers generally would have not taken the risk of buying these properties they may never own. However, these lawyers appear to be safe in the knowledge that they were protected by the Cyprus Bar and their fellow lawyers who would not take on negligence cases against them.

It is also true that both foreign and Cypriot agents, hooked on the high commissions, also went along with the lack of due diligence and non-disclosure of developer mortgages.

Only through this organised deception was the pyramid scheme-like system of debt and risk able to be created into the monstrous situation which exists today.

In 2008, the total outstanding on developer mortgages was around €3billion – however, currently this total stands at around €6billion!

Furthermore, new property sales have slumped since 2008 and show no signs of recovering, meaning that despite rescheduling (either overtly or covertly) by the banks of this debt and spiralling bank provisions for the writing off of bad debts, the picture is bleak for all concerned. We have warned of the dangers of this developer toxic debt for the last couple of years but this has fallen on deaf ears.

Are Buyers Protected?

Buyers are falsely assured by the industry and Cyprus Government that even though things are done differently in Cyprus and they don’t get Title Deeds issued for their property as soon as the full purchase price is paid, as in other countries, that nevertheless, whatever happens they are fully protected until this time. They are assured that by lodging their sales contract at the Land Registry they are fully protected under the Specific Performance law. However, this is untrue and in a current high profile case where a developer resold a property whose sales contract was lodged at the Land Registry the Attorney General has publicly stated that this is not even a criminal offence.

Unfortunately, the truth is that should any developer become bankrupt prior to the transfer of individual deeds (and this is already happening), then the buyers become victims of a biased liquidation scenario whereby unless they can pay off ‘their share’ of the developer’s related debts and taxes, lawyers fees and hefty Receiver’s fees they stand to have their home repossessed by the bank. This whole operation can take years and in the meantime the banks continue to rack up highly inflated interest and penalty charges adding substantially to the potential costs for these buyers.

Fully protected? – what do you think!

( Note : More to come – this page is under further development)

WARNING : Buying from Cypriot Developers may seriously damage your Wealth !

© 2011 Cyprus Property Action Group